income tax calculator indonesia

The following year when you report on 2021 the CIT will be 20 from the net profit of the company. 21 Income Tax rates.

Taxation System In Indonesia Your Guide To Income Taxation

Thus resident taxpayers have to calculate and settle ie if the Annual Individual Income Tax Return AIITR is showing underpayment amount and submit for the AIITR accordingly.

. If you need to convert another. Total Annual Net Income. VAT on the export of taxable tangible and intangible goods as well as export of services is fixed at 0 percent.

2 1 8939700 178794. And the tax value depends on the hs code of each product with PIB Pemberitahuan Impor Barang information. 2 x 600000000 12000000 Personal allowances 54000000 3 x 4500000 67500000 Pension contribution.

If you are S-0 for the tax year 2014 your tax exempt income becomes Rp 24300000 dan if you are M-2 in the year 2015 your tax exempt income becomes Rp 45000000. Certain types of income earned by resident taxpayers or indonesian pes are subject to final income tax. The calculator is designed to be used online with mobile desktop and tablet devices.

Total value Import Duty x percentage of Income Tax. The tax authorities have the right to audit any tax return to ensure the individual has correctly calculated the tax payable within the 5-year statute of limitations. Personal Income Tax Rate Rp An extra 20 is levied on people who do not have a tax number NPWP on top of progressive income tax rates above.

Last reviewed - 30 December 2021. Calculate your net salary after tax in Indonesia with our easy to use and up-to-date 2022 income tax calculator. In-kind benefits paid for by the employer such as.

Effective fiscal year 2022 the lowest tax bracket cap for individual income tax will be. Indonesia adopts a self-assessment system. However the exact rate may be increased or decreased to 15 percent or 5 percent according to government regulation.

As for tax residents they are taxed based on a progressive rate between 5 and 30. Indonesian residents qualify for personal tax relief as seen in the table below. Deductions for an individual are Rp.

This calculator uses IDR Indonesian Rupiah. Value Added Tax VAT PPn. Income Tax PPh.

Generally the VAT rate is 10 percent in Indonesia. Vary from 0-450 depending on the HS Code of the goods. Import Duty BM.

And here are 3 types of taxes you need to know. Indonesia Income Tax Rates For 2022 Activpayroll How To Calculate Income Tax In Excel Asiapedia Iras 2017 Singapore Personal Income Tax. How to calculate import taxes simulation in Indonesia.

Total value Import Duty x 10. It can be a little complicated because you first need to know the HS code and search it to. This field is adjusted toward your status eg.

Employment income in Indonesia is subject to tax regardless of where the income is paid. In Indonesia a general flat rate of 25 applies becoming 22 in 2020. Income Tax PPh.

For 2021 tax year. 9172021 0 Comments Similar to the severance payments made in year three and onwards the gross income is taxed at the normal IIT ratesIt is crucial to do the reporting correctly to avoid penalties and additional expenses. However the new Omnibus Law has added a provision to the Income Tax Law stipulating that foreigners who have become domestic tax.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. Such a payment is referred to as article 29 income tax. All companies doing business in Indonesia both locally owned and foreign owned are required to fulfill the corporate income tax obligations.

The Annual Wage Calculator is updated with the latest income tax rates in Indonesia for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Non-residents are subject to a 20 withholding tax on any income sourced within Indonesia. This is an income tax calculator for indonesia.

This field is adjusted toward your status Eg. The calculator only includes the individual tax-free allowance of IDR 24300000. Indonesia Income Tax Calculator.

Tax rates range from 0 to 30. Point 13 multiplied by 12. 2880000 wife 2880000 and up to three children Rp.

Import Duty BM. This means that when you report on your taxes from January 2021 to December 2021 your company will be paying 22 of CIT from the net profit of the company. A tax resident is generally taxed on worldwide income although this may be mitigated by the application of double taxation agreements DTAs.

This is an income tax calculator for Indonesia. This includes corporate income tax personal income tax withholding taxes international tax agreements value-added tax VAT and many more. However if your company is a public company that satisfy the minimum listing requirement of 40 in Indonesia Stock Exchange IDX and.

There is a wide variety of taxes in Indonesia that companies investors and individuals need to comply with. Indonesia - utilizes the self-assessment method for individuals to calculate settle and report income tax. The corporate income tax the CIT rate will decrease next year by 2.

How to calculate the total cost of import in Indonesia To calculate the total import tax you will first need to convert the total value of the goods to Indonesian Rupiah using the following formula. Indonesian tax resident and non-resident taxpayers who have Tax Identification Numbers Tax-ID are generally taxed on a. Tax name in Indonesia.

In addition to salary taxable employment income includes bonuses commissions overseas allowances and fixed allowances for education housing and medical care. TOTAL VALUE IN IDR Total Value in USD Total CIF x IDR exchange rate CIF Freight on Board Insurance Freight Cost x exchange rate. Annual Tax Exempt Income.

Individual - Taxes on personal income. Occupational expenses 5 from gross income or maximum 6000000 6000000 Old age saving contribution paid by employee. Annual gross income.

Annual PPh 21 Tax. Calculate Employee Income Tax in Indonesia. Total value x percentage of import duty.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Corporate Income Tax Rate. Taxable Income MYR Tax Rate.

Review the full instructions for using the Indonesia Salary After Tax Calculators which details.

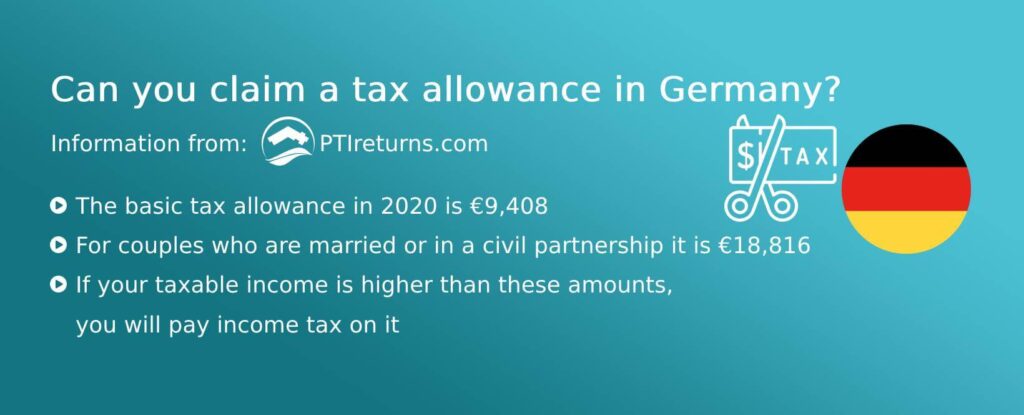

German Rental Income Tax How Much Property Tax Do I Have To Pay

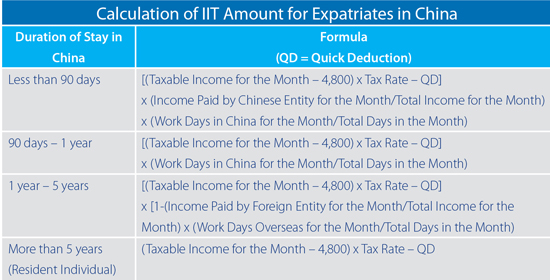

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

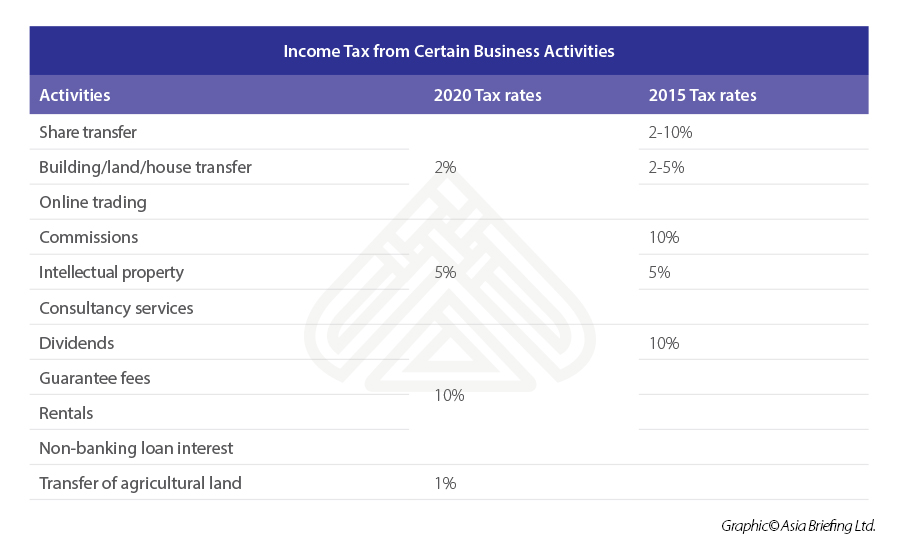

How To Calculate Income Tax In Excel

Indonesia Income Tax Rates For 2022 Activpayroll

How To Calculate Foreigner S Income Tax In China China Admissions

![]()

Indonesia Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Income Taxes Preparing A U S Tax Form With Money In Mind Spon Preparing Taxes Income Tax Mind Ad Income Tax Income Tax Forms

How To Calculate Income Tax In Excel

Tax Identification Numbers In Laos Compliance By June 2021

Senior Tax Manager Job Description Example Job Description And Resume Examples Income Tax Return Indirect Tax Income Tax

Tax Identification Numbers In Laos Compliance By June 2021

Download Income Tax Calculator Free For Pc Ccm

German Rental Income Tax How Much Property Tax Do I Have To Pay

Jember East Java Indonesia June 14 2018 Yoga Journal App In Play Store Close Up On The Laptop Screen Ad Journal App Business Brochure Brochure Template

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

How Indonesia Payroll Works Payroll Taxes Payroll Hiring Employees

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News